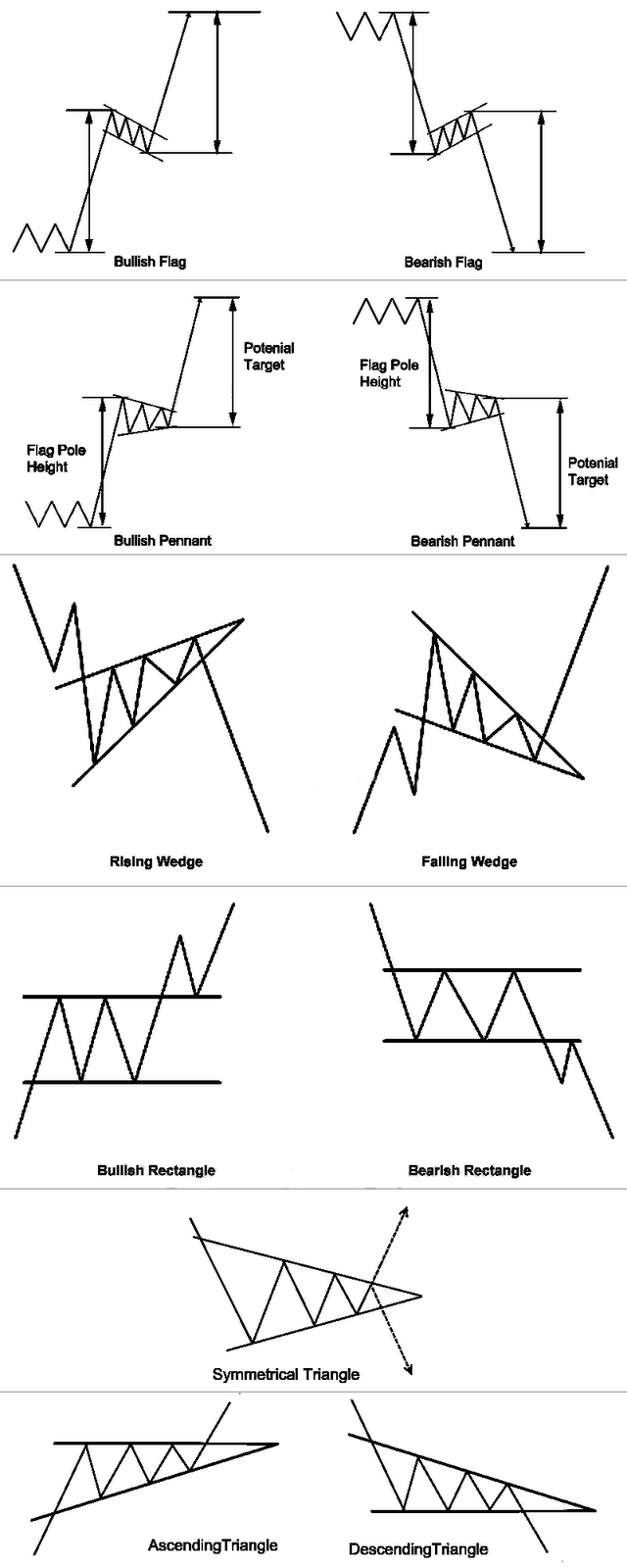

Normally where the trend lines close in on each other. Your entry point will come as volume increases and there is confirmation of a break out of resistance.

#Chart patterns series#

There will be a series of lower highs and higher lows. After a bullish run up you will wait for the pennant shape to form. You trade a Bull Pennant in a similar way to a Bull Flag.

Knowing this can help confirm the pattern. The volume then increases again off the reversal of C, slows as it nears D and increases as the reversal begins to take shape off D.Ĭonsolidation periods have lower volume and breakouts have higher volume. A rally from A to B will have high volume, with the consolidation (BC) at a lower volume. When considering this trading pattern it is good to look at other technical indicators. The points of resistance off the reversal are point B and C, and then finally point A. When price hits point D it typically forms a strong uptrend reversal. The third leg (CD) then forms after a second strong downtrend of a similar size of AB. The second leg (BC) forms by a smaller retracement forming the C. The first leg (AB) is drawn from point A to B in a strong downtrend. There are 3 legs (AB, BC, CD), and 4 points (ABCD). These trading graph pattern look like a “lightning bolt” trending downward. The Bullish ABCD chart pattern is similar to an ABC pattern in that it is a harmonic trading pattern.īullish ABCD trading patterns form when a down trend retraces up and then pulls back creating a second, equal downtrend. Price does eventually trend higher than the length of AB and I reach Target 2 and take profit on the remaining position.

Note if I put my stop all the way up to T1 I would get stopped out and miss T2. When price reaches Target 1 (T1) I reduce my position by half and move my stop halfway to my T1 level. I have copied the leg from A to B and used it to measure my second target. I have decided to make the resistance at pivot B as my first target. I miss part of the move but that’s ok, I want to make sure the pattern has a chance to complete. In the example below I chose to wait for some resistance (on the left) to clear before I entered. You can use this information to find a larger target or a secondary target. The uptrend from C is often roughly the same size as the trend from A to B. We know that the next major resistance level is point B in the pattern, you can choose this as your target or first of 2 targets. You can enter the trade at this point and place your stop loss just below C as this is the support level.ĭon’t enter the trade if there are any unrelated resistance levels, wait for those to be broken. Once you have a close of the first green candle reversing off C you have confirmation of the reversal. To trade a Bullish ABC pattern, wait for confirmation of a reversal at point C.

0 kommentar(er)

0 kommentar(er)